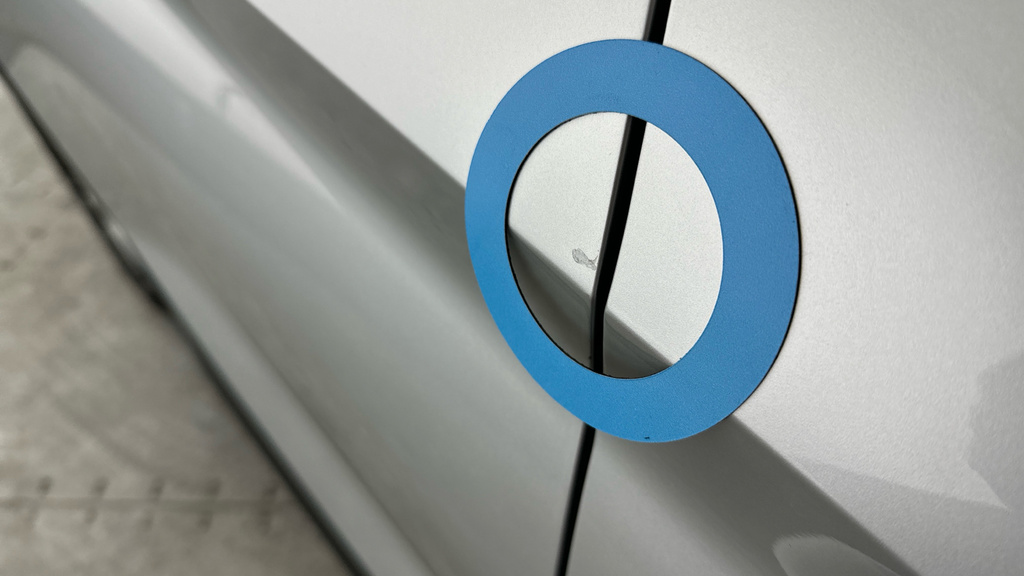

2021 Skoda Kodiaq

Se L

32,620miAutoPetrol1.5L

£23,400

Online Dealer

~£588/pm

Coming in the tone of silver, this car has a 1.5L petrol motor with automatic transmission and it has 32,620 miles clocked up on the dash.

Representative example: borrowing £6,500 over 5 years with a representative APR of 19.9%, an annual interest rate of 19.9% (Fixed) and a deposit of £0.00, the amount payable would be £166.07 per month, with a total cost of credit of £3,464.37 and a total amount payable of £9,964.37.

864 cars

1/24

1/24

Se L

32,620miAutoPetrol1.5L

£23,400

Online Dealer

~£588/pm

Coming in the tone of silver, this car has a 1.5L petrol motor with automatic transmission and it has 32,620 miles clocked up on the dash.

1/12

1/12

2.0 Tsi 190Ps 4X4 Sportline 7 Seats Dsg Suv

15,750miAutoPetrol2.0L

£31,495

Horsham

~£791/pm

Up for sale and ready for you to take home is this Skoda Kodiaq that is fitted out with a 2.0l petrol motor and automatic transmission. This used model available from this dealership in Horsham has clocked up 15,750 miles.

1/14

1/14

2.0 Tdi Sport Line 4X4 7 Seat - Suv

54,000miManualDiesel2.0L

£23,254

Weston-super-Mare

~£584/pm

Become the new owner of this suv fitted with a 2.0L diesel motor and manual transmission. This second hand model has 54,000 miles clocked up on the dashboard.

1/12

1/12

1.5 Tsi 150Ps Se L 7 Seats Act Dsg Suv

24,100miAutoPetrol1.5L

£26,295

Horsham

~£660/pm

Currently available from our dealership in the Horsham area is this Skoda Kodiaq 1.5 Tsi 150Ps Se L 7 Seats Act Dsg Suv that has a 1500 CC petrol engine with automatic transmission. It is up for sale in the tone of grey with 24,100 miles clocked up on the dash.

1/25

1/25

1.5 Tsi Se Dsg

28,451miAutoPetrol1.5L

£21,270

Preston

~£534/pm

This Kodiaq 1.5 Tsi Se Dsg has 28,451 miles clocked-up on the dash and is fitted with a 1.5 Ltr engine. It runs on petrol with automatic transmission and has been finished in the shade of black.

1/15

1/15

2.0 Tdi Scout 4X4 Dsg 7 Seat

39,394miAutoDiesel2.0L

£24,998

Irvine

~£628/pm

On the market and ready for its next owner to drive away today is this near mint, low mileage Skoda Kodiaq 2.0 Tdi Scout 4X4 Dsg 7 Seat, it incorporates a L engine with transmission. This second hand one comes in and has done a mere few miles.

1/43

1/43

1.5 Se L Tsi Dsg 148 Bhp

63,427miAutoPetrol1.5L

£18,590

Newcastle upon Tyne

~£467/pm

Priced at £18,590 you can buy this used Skoda from this dealership in Newcastle upon Tyne that comes with automatic transmission and a 1.5 L petrol motor.

1/46

1/46

Skoda Kodiaq Se L 7 Seats 1.5 Tsi 150 Ps Dsg

21,871miAutoPetrol

£25,400

Cambridge

~£638/pm

This estate used car has got 21,871 miles clocked-up on the dash and comes equipped with a Ltr petrol motor.

1/1

1/1

2.0 Tsi Se L 4X4 Dsg 7 Seat

70,503miAutoPetrol2.0L

£18,998

Fortrose

~£477/pm

Currently available at our dealership in the Fortrose area is this almost spotless, like new Skoda Kodiaq which is equipped with a cc engine with transmission. It's on the market and ready for its new owner to drive away painted in the tone of with only few miles clocked up on the dash.

1/50

1/50

Vrs

36,274miAutoDiesel2.0L

£28,995

Chorley

~£728/pm

This Skoda Kodiaq Vrs only has 36,274 miles on the dash and has been on the road for less than a year.

1/30

1/30

1.5 Tsi Act Se L Suv Dsg Euro 6 Ss

21,785miAutoPetrol1.5L

£26,224

Reading

~£659/pm

This used Kodiaq 1.5 Tsi Act Se L Suv Dsg Euro 6 Ss coming in blue is on the market and ready for you to drive home with the added option for you to get it on finance.

1/43

1/43

2.0 Tdi Se L Suv Dsg 7 Seat 150 Ps

72,917miAutoDiesel2.0L

£16,795

Norwich

~£422/pm

This Kodiaq is equipped with a 2000cc diesel motor with automatic transmission and has 72,917 miles clocked up on the dashboard.

1/31

1/31

1.5 Tsi Dsg Se Drive Cwvehiclemarketing

15,394miAutoPetrol1.5L

£26,091

Royal Leamington Spa

~£655/pm

On offer and ready for its new owner to drive away today is this Kodiaq 1.5 Tsi Dsg Se Drive Cwvehiclemarketing, it features automatic transmission and a 1.5 litre petrol motor. This used model has 15,394 miles clocked up on the dash and comes in blue.

1/47

1/47

Skoda Estate 1.4 Tsi 150 Se L Dsg

71,537miAutoPetrol1.4L

£16,990

Kidlington

~£427/pm

Become the new owner of this Skoda Kodiaq Skoda Estate 1.4 Tsi 150 Se L Dsg which has got automatic transmission and a 1.4 litre petrol engine. This second hand one at this dealer in Kidlington has been finished in the shade of grey and has 71,537 miles on the dash.

1/11

1/11

Tsi Act Edition

85,494miAutoPetrol1.4L

£15,995

Croydon

~£402/pm

A 1400CC petrol engine and automatic transmission are only some of the qualities that this car has to offer.

1/12

1/12

2.0 Tsi 190Ps 4X4 Laurin Klement 7S Dsg

30,150miAutoPetrol2.0L

£30,995

Horsham

~£778/pm

A remarkable price of just £30,995 from this dealer for this low mileage Kodiaq that has just 30,150 miles on the clock.

1/50

1/50

2.0 Tdi Se L Dsg

39,220miAutoDiesel2.0L

£20,906

Liverpool

~£525/pm

With a 2.0 Ltr diesel motor with automatic transmission, this used Skoda Kodiaq from this dealership in Liverpool is on offer with a blue finish and has 39,220 miles on the dashboard.

1/38

1/38

Se Drive

20,080miAutoPetrol1.5L

£24,150

Online Dealer

~£606/pm

On offer and ready for its new owner to drive away today is this Kodiaq Se Drive, it is fitted out with automatic transmission and a 1500cc petrol motor. This second-hand model in stock at our dealership in Online Sale is for sale at our low price of just £24,150.

1/10

1/10

2.0 Tsi Se L Executive Dsg 4Wd Euro 6 Ss

31,918miAutoPetrol2.0L

£29,999

King's Lynn

~£753/pm

Painted in the tone of , this suv second hand car has 31,918 miles on the dashboard and comes fitted with a automatic 2.0L engine running on petrol.

1/2

1/2

1.5 Tsi Se L Dsg 7 Seat

45,950miAutoPetrol1.5L

£21,270

Liverpool

~£534/pm

Coming equipped with automatic transmission and a 1.5 litre petrol engine: this silver second-hand Skoda Kodiaq 1.5 Tsi Se L Dsg 7 Seat is on offer and ready for you to drive home with 45,950 miles on the clock.

1/3

1/3

2.0 Tdi Se L Dsg 7 Seat - Suv

42,618miAutoDiesel2.0L

£23,218

Weston-super-Mare

~£583/pm

This Skoda Kodiaq 2.0 Tdi Se L Dsg 7 Seat - Suv has 42,618 miles clocked up on the dashboard and comes fitted out with a 2.0 LTR engine. It runs on diesel with automatic transmission and is finished in blue.

1/17

1/17

Suv 1.5 Tsi Act Se Dsg Euro 6 Ss 7 Seat

44,344miAutoPetrol1.5L

£18,990

Stanmore

~£477/pm

Coming fitted out with a 1500 cc petrol engine and automatic transmission, this used Kodiaq from this dealership in Stanmore is on the market in a blue finish and has 44,344 miles on the clock.

1/16

1/16

1.5 Tsi 150Ps Se Drive 7 Seats Act

14,435miAutoPetrol1.5L

£27,750

Dundee

~£697/pm

The awesome price of just £27,750 is currently being offered by our dealership for this almost spotless, nearly new, low mileage Skoda Kodiaq that only has 14,435 miles on the clock.

1/12

1/12

1.5 Tsi 150Ps Se L 7 Seats Act Dsg Suv

54,350miAutoPetrol1.5L

£20,946

Horsham

~£526/pm

This motor has 54,350 miles clocked up on the dashboard and comes fitted with a 1500CC petrol engine and automatic transmission.

Research the Vehicle:

Types of Finance Options:

Shop Around:

Credit Score Check:

Set a Budget:

Examine the Terms:

Negotiate:

Close the Deal:

Insurance:

End of Agreement Choices:

Always ensure that any finance agreement aligns with your financial situation and long-term plans. If uncertain, seek advice from independent financial advisors or professionals before committing.

When one thinks of an SUV that harmoniously combines style, practicality, and value, the Škoda Kodiaq often comes to mind. A relatively new entrant to the car scene, the Kodiaq has already made substantial inroads in the UK's SUV landscape.

Origins and Evolution: The Kodiaq's journey began in 2016, marking Škoda's ambitious foray into the large SUV domain. Named after the Kodiak bear from Alaska, this vehicle mirrored its namesake's strength and presence. From its initial unveiling, it was clear: Škoda was not just introducing an SUV; they were setting a new benchmark for what's expected in this segment.

Tailored for the British Climate and Roads: Designed with adaptability in mind, the Kodiaq navigates the diverse British terrains with ease. Whether it’s the rain-soaked streets of Manchester or the snowy roads of the North, the Kodiaq’s dynamic chassis control ensures stability. Its spacious interiors, capable of seating up to seven, makes it an ideal choice for families across Britain.

Facing the Competition: In a segment teeming with contenders like the Kia Sorento, Nissan X-Trail, and Peugeot 5008, the Kodiaq holds its own, thanks largely to its blend of functionality, premium feel, and competitive pricing. The signature Škoda 'Simply Clever' features further differentiate it, offering practical solutions that everyday drivers appreciate.

Final Thoughts: The Škoda Kodiaq is a testament to the brand's capability to craft a vehicle that resonates with the needs and desires of the modern UK driver. With its perfect blend of luxury, performance, and affordability, especially when considered with finance options, the Kodiaq stands as a compelling choice for those venturing into the SUV segment.

Skoda Kodiaq data for the amount in stock, average price, age and mileage throughout the UK and by county.

| County | Stock | Avg Price | Avg Age | Avg Mileage | Recent Sales |

|---|---|---|---|---|---|

| All | 854 | £24,660 | 4 | 38,009 | 2,350 |

| Aberdeen City | 6 | £29,800 | 3 | 18,360 | 14 |

| Aberdeenshire | 1 | £28,995 | 4 | 20,350 | 5 |

| Antrim | 1 | £18,495 | 6 | 72,901 | 1 |

| Ards | 1 | £19,295 | 7 | 37,197 | 2 |

| Ballymena | 2 | £20,973 | 6 | 78,000 | 1 |

| Ballymoney | 2 | £19,295 | 5 | 51,585 | 2 |

| Banbridge | 1 | £21,495 | 5 | 47,000 | 1 |

| Bedfordshire | 20 | £27,457 | 3 | 26,246 | 46 |

| Belfast | 6 | £26,345 | 3 | 33,338 | 6 |

| Berkshire | 29 | £32,333 | 2 | 13,502 | 73 |

| Bristol | 21 | £22,604 | 4 | 44,227 | 31 |

| Bromley - Greater London | 1 | £16,995 | 6 | 74,168 | 1 |

| Buckinghamshire | 9 | £28,431 | 3 | 37,286 | 21 |

| Cambridgeshire | 30 | £23,166 | 4 | 44,016 | 54 |

| Cardiff | 2 | £29,495 | 4 | 24,547 | 15 |

| Cheshire | 36 | £27,459 | 4 | 30,165 | 91 |

| City of Edinburgh | 14 | £30,633 | 3 | 19,050 | 18 |

| City of London - Greater London | 40 | £28,000 | 3 | 28,018 | 118 |

| Coleraine | 1 | £24,995 | 2 | 58,000 | 1 |

| Cornwall | 3 | £29,211 | 4 | 32,125 | 13 |

| County Durham | 7 | £22,459 | 5 | 49,782 | 27 |

| Craigavon | 2 | £23,999 | 4 | 35,070 | 2 |

| Croydon - Greater London | 7 | £26,626 | 4 | 32,420 | 30 |

| Derbyshire | 19 | £24,254 | 4 | 37,394 | 50 |

| Devon | 6 | £23,590 | 5 | 35,095 | 36 |

| Dorset | 6 | £23,594 | 5 | 30,485 | 14 |

| Down | 2 | £18,645 | 4 | 41,098 | 5 |

| Dundee City | 7 | £26,479 | 3 | 20,803 | 20 |

| Dungannon | 1 | £25,995 | 4 | 30,323 | 1 |

| Ealing - Greater London | 1 | £20,000 | 5 | 89,259 | 1 |

| East Ayrshire | 2 | £24,498 | 5 | 32,273 | 9 |

| East Riding of Yorkshire | 4 | £27,582 | 2 | 10,934 | 9 |

| East Sussex | 3 | £34,300 | 2 | 15,395 | 12 |

| Enfield - Greater London | 2 | £20,665 | 4 | 41,783 | - |

| Essex | 17 | £22,042 | 5 | 35,353 | 63 |

| Falkirk | 1 | £24,498 | 6 | 12,799 | - |

| Fermanagh | 1 | £15,995 | 6 | 108,000 | 2 |

| Fife | 7 | £25,342 | 4 | 43,592 | 11 |

| Glasgow City | 5 | £29,617 | 2 | 19,269 | 43 |

| Gloucestershire | 9 | £30,122 | 2 | 16,301 | 30 |

| Greater Manchester | 24 | £27,937 | 3 | 22,670 | 119 |

| Hampshire | 28 | £27,887 | 3 | 27,818 | 124 |

| Harrow - Greater London | 1 | £18,990 | 5 | 44,344 | 6 |

| Havering - Greater London | 1 | £21,975 | 3 | 49,369 | 2 |

| Herefordshire | 1 | £21,395 | 7 | 33,056 | 1 |

| Hertfordshire | 20 | £27,188 | 3 | 29,853 | 66 |

| Highland | 6 | £26,780 | 4 | 38,226 | 9 |

| Hillingdon - Greater London | 1 | £16,451 | 6 | 70,833 | - |

| Inverclyde | 2 | £23,398 | 5 | 17,420 | 2 |

| Kent | 38 | £29,027 | 3 | 22,054 | 122 |

| Kingston upon Thames - Greater London | 1 | £18,990 | 7 | 57,400 | 1 |

| Lancashire | 32 | £25,037 | 4 | 33,758 | 81 |

| Leicestershire | 8 | £25,275 | 4 | 33,325 | 29 |

| Lincolnshire | 7 | £21,770 | 5 | 39,699 | 22 |

| Magherafelt | 5 | £22,926 | 6 | 70,560 | - |

| Merseyside | 16 | £27,135 | 3 | 25,071 | 23 |

| Newport | 9 | £27,200 | 2 | 20,542 | 17 |

| Newry and Mourne | 1 | £22,499 | 3 | 40,740 | 4 |

| Newtownabbey | 2 | £17,997 | 4 | 53,873 | 10 |

| Norfolk | 8 | £31,979 | 2 | 16,888 | 37 |

| North Ayrshire | 1 | £24,998 | 5 | 39,394 | 1 |

| North Lanarkshire | 1 | £24,498 | 4 | 23,580 | 6 |

| North Yorkshire | 26 | £25,615 | 3 | 24,173 | 34 |

| Northamptonshire | 13 | £27,710 | 3 | 24,814 | 37 |

| Northumberland | 1 | £19,498 | 6 | 29,791 | 2 |

| Nottinghamshire | 11 | £29,367 | 2 | 27,324 | 50 |

| Omagh | 2 | £21,175 | 6 | 72,884 | 4 |

| Oxfordshire | 13 | £24,551 | 4 | 42,657 | 38 |

| Perth and Kinross | 3 | £25,000 | 3 | 33,147 | 18 |

| Powys | 2 | £16,893 | 6 | 91,258 | - |

| Renfrewshire | 7 | £32,398 | 2 | 15,027 | 13 |

| Shropshire | 1 | £16,899 | 4 | 63,806 | 4 |

| Somerset | 23 | £26,856 | 4 | 28,442 | 49 |

| South Ayrshire | 3 | £25,811 | 4 | 47,016 | 7 |

| South Yorkshire | 27 | £26,036 | 3 | 29,643 | 70 |

| Staffordshire | 17 | £25,278 | 4 | 30,744 | 30 |

| Stirling | 4 | £28,325 | 2 | 31,252 | 17 |

| Suffolk | 16 | £28,111 | 3 | 28,668 | 37 |

| Surrey | 17 | £23,812 | 4 | 34,301 | 33 |

| Swansea | 11 | £26,189 | 4 | 28,425 | 20 |

| Tyne and Wear | 12 | £26,304 | 4 | 39,425 | 49 |

| Waltham Forest - Greater London | 3 | £21,405 | 4 | 36,726 | - |

| Warwickshire | 3 | £28,716 | 2 | 31,861 | 15 |

| West Dunbartonshire | 1 | £23,995 | 6 | 61,079 | 3 |

| West Lothian | 1 | £20,498 | 6 | 52,664 | 2 |

| West Midlands | 22 | £26,606 | 3 | 27,231 | 78 |

| West Sussex | 21 | £23,461 | 4 | 38,187 | 52 |

| West Yorkshire | 32 | £24,464 | 4 | 28,130 | 74 |

| Wiltshire | 3 | £18,662 | 6 | 60,944 | 19 |

| Worcestershire | 11 | £28,681 | 2 | 23,240 | 34 |