Getting a Mercedes-Benz SL Class on finance

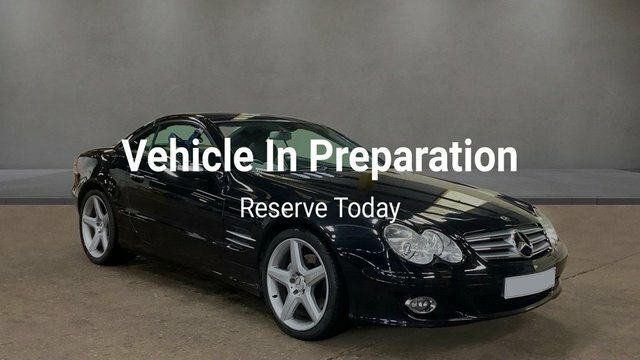

Thinking about getting a used Mercedes-Benz SL Class on finance? This iconic roadster could be yours. Here's the lowdown.

Q: Why the SL Class? A: The SL Class stands out for its luxurious feel, powerful performance, and top-notch features. Still, make sure to read some reviews and maybe even test drive one to ensure it's the right fit for you.

Q: Where can I find one? A: Start with Mercedes-Benz’s official used car listings. But also keep an eye on online car sale platforms, Mercedes dealers in your area, and local classified ads.

Q: How do I finance it? A:

- PCP: Put down a deposit, then make monthly payments. At the end, buy the car, trade it in, or return it.

- HP: Pay a deposit, then regular instalments. Once all payments are done, the SL Class is all yours.

- Leasing: It's like renting the car. Use it for a set period, then return it.

- Personal Loan: Borrow the cash, buy the car, then pay back the loan bit by bit.

Q: How do I make sure I'm getting value for money? A: Do your homework. Get quotes from Mercedes-Benz finance and other lenders. To understand the total cost, check the APR.

Q: My credit score – does it matter? A: Absolutely. A better score can help you get a sweeter deal. You can get your score from places like CheckMyFile or ClearScore.

Q: What should I budget? A: Decide on a monthly spend you're comfy with. Remember, the bigger your deposit, the less you'll pay monthly.

Q: Any contract traps? A: If you go with PCP or a lease, watch out for mileage caps. And always see if there's a cost for bailing out early.

Q: Can I get a better price? A: Why not try? Negotiate a bit. You might score a discount on the SL Class or better finance terms.

Remember to always understand all contract details. Good luck, and here's hoping you'll soon be cruising in your Mercedes-Benz SL Class!

About the Mercedes-Benz SL Class

The Mercedes-Benz SL Class, with its lineage dating back to the 1950s, has long been synonymous with luxury, performance, and cutting-edge technology. Designed for the discerning British motorist who values heritage as much as modern sophistication, the SL Class remains an icon in the UK's luxury convertible market.

A Rich Historical Tapestry:

The journey of the SL Class began with the 1954 "Gullwing" 300 SL – a car that's etched in automotive history for its distinct upward-opening doors and unmatched elegance. Over the decades, the SL Class has evolved, but its essence as a performance-oriented luxury roadster remains unchanged.

Engineering Brilliance with Luxe:

Each iteration of the SL Class combines performance with luxury. Its V8 and V12 engines, available in various models, offer a thrilling drive while the plush interiors, adorned with the finest materials, ensure that every journey is an experience in itself. Advanced tech features and driver aids further elevate the driving experience, catering to modern-day conveniences and safety.

Amongst Elite Contenders:

In the British luxury roadster segment, the SL Class faces competition from models like the Porsche 911 Cabriolet and Jaguar F-TYPE. Yet, the Mercedes stands distinct, thanks to its unique blend of history, innovation, and sheer driving pleasure.

Final Words:

The Mercedes-Benz SL Class isn't just a car; it's an embodiment of automotive passion, engineering excellence, and luxurious craftsmanship. For those in the UK seeking an epitome of top-down motoring with a legacy that few can match, the SL Class awaits. And with a range of financing options available, the path to ownership has never been more inviting.