2022 Hyundai Kona

Premium

14,454miManualPetrol1.0L

£16,995

Online Dealer

~£427/pm

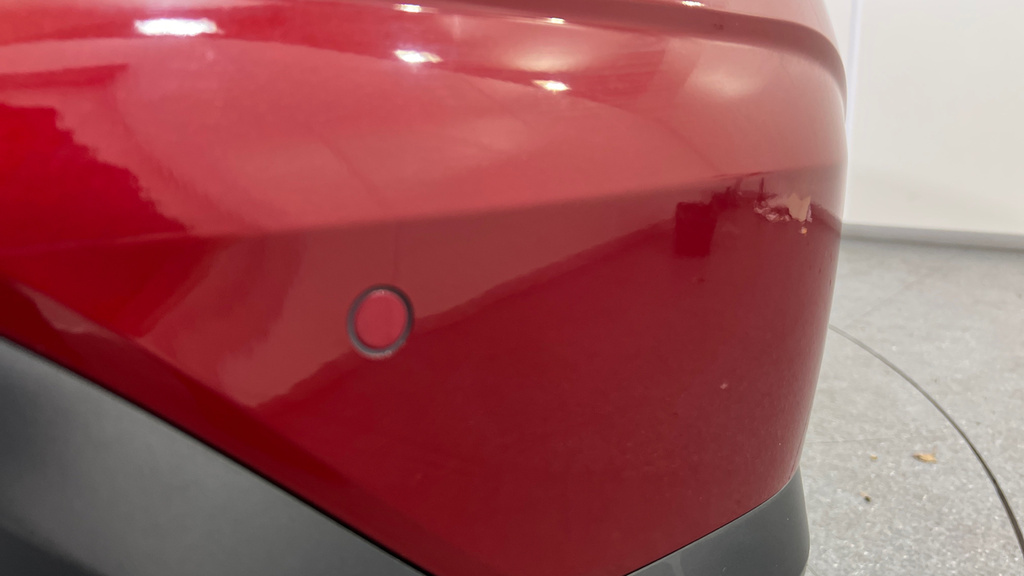

Up for sale is this Hyundai in a like new condition which has 14,454 miles on the clock.

Representative example: borrowing £6,500 over 5 years with a representative APR of 19.9%, an annual interest rate of 19.9% (Fixed) and a deposit of £0.00, the amount payable would be £166.07 per month, with a total cost of credit of £3,464.37 and a total amount payable of £9,964.37.

1,684 cars

1/22

1/22

Premium

14,454miManualPetrol1.0L

£16,995

Online Dealer

~£427/pm

Up for sale is this Hyundai in a like new condition which has 14,454 miles on the clock.

1/56

1/56

1.6 Gdi Premium 140 Bhp

34,155miAutoHybrid1.6L

£14,695

Corby

~£369/pm

Currently available from this supplier's showroom - orange door, Hyundai Kona 1.6 Gdi Premium 140 Bhp fitted with a automatic gearbox and 1.6L hybrid engine.

1/24

1/24

1.0 T-gdi 120Ps Advance

6,664miManualPetrol1.0L

£22,999

Boston

~£578/pm

This Hyundai is finished in the shade of white and although it is a second hand vehicle, it is still in a splendid, like new condition inside and out. This particular model incorporates a 1.0 litre petrol motor with manual transmission and has 6,664 miles on the clock.

1/19

1/19

Se Connect

5,917miManualPetrol1.0L

£15,990

Online Dealer

~£402/pm

Interested in buying a Hyundai Kona? Then take a look at this second-hand, but near mint one which is in an almost pristine, nearly new condition in and out. This model that's currently on display at our dealership has 5,917 miles clocked up on the dash and contains a 1.0 Litre petrol engine with manual transmission.

1/17

1/17

1.0 T-gdi Mhev Se Connect Euro 6...

41,418miManualHybrid1.0L

£13,289

Weston-super-Mare

~£334/pm

First registered in 2021: Second-hand Hyundai Kona that has manual transmission, only 41,418 mi clocked up on the dash and a 1.0l hybrid motor.

1/39

1/39

1.0 Tgdi 48V Mhev Premium

15,790miManualHybrid1.0L

£16,952

Pontypridd

~£426/pm

Currently advertised by this dealer - Kona 1.0 Tgdi 48V Mhev Premium that incorporates a 1.0L hybrid motor with manual transmission.

1/24

1/24

1.0 T-gdi Blue Drive Se Euro 6 Ss

35,209miManualPetrol1.0L

£10,437

Manchester

~£262/pm

Become the new owner of this manual Hyundai Kona with manual transmission and a 1.0 ltr petrol engine. This second hand one has 35,209 miles on the clock and comes in orange.

1/18

1/18

Premium Se

21,122miManualPetrol1.0L

£13,070

Online Dealer

~£328/pm

This suv second hand car has been used for less than a year and has just 21,122 miles clocked up on the dashboard.

1/12

1/12

1.6 H Gdi Premium Suv Hybrid Dct Euro 6

22,650miAutoPetrol1.6L

£18,395

Southend-on-Sea

~£462/pm

With a mere 22,650 miles on the dashboard and painted in the tone of red, this Kona comes equipped with automatic transmission and has a 1.6 Ltr petrol motor. Available on the market at the fabulous price of just £18,395 or with the option to buy using finance with affordable repayments available starting at £ monthly.

1/19

1/19

1.6 Gdi Hybrid Premium Dct

9,848miAutoHybrid1.6L

£17,998

Aberdeen

~£452/pm

Currently available for sale today is this Hyundai Kona 1.6 Gdi Hybrid Premium Dct featuring a 1600cc hybrid motor with automatic transmission. At the marvellous price of £17,998 and affordable repayments at hand commencing from as little as £ per month.

1/39

1/39

1.0 Premium Se

9,000miManualPetrol1.0L

£13,990

St Neots

~£351/pm

For Sale: Hyundai Kona 1.0 Premium Se - 9,000 miles, manual transmission and 1000cc petrol motor.

1/19

1/19

1.0T Gdi Blue Drive Premium

15,655miManualPetrol1.0L

£15,698

Aberdeen

~£394/pm

Near mint Hyundai with low mileage now up for sale at £15,698 or on credit starting out at only £ per calendar month. It contains a 1.0 LTR petrol engine with manual transmission and only has 15,655 miles on the clock.

1/32

1/32

Gdi Premium Se

5,410miAutoHybrid1.6L

£18,999

Glastonbury

~£477/pm

This second-hand Hyundai Kona Gdi Premium Se from this dealer in Glastonbury is equipped with a 1.6 Ltr hybrid engine with automatic transmission and has got 5,410 miles on the dash.

1/19

1/19

Premium Gt

14,108miAutoPetrol1.6L

£16,615

Online Dealer

~£417/pm

Up for sale and ready for you to drive away today is this Hyundai Kona Premium Gt which incorporates a 1.6 L petrol engine and automatic transmission. This second hand low mileage one at this dealership has only got 14,108 miles on the dashboard.

1/18

1/18

150Kw Premium 64Kwh

19,774miAutoElectric

£20,498

Stourbridge

~£515/pm

Become the next owner of this Kona, it has got a Ltr electric engine with automatic transmission. This second hand model at this dealer priced at £20,498 has 19,774 miles clocked-up on the dash and has been finished in the shade of white.

1/21

1/21

Premium

25,492miManualPetrol

£14,995

High Wycombe

~£377/pm

Looking out to buy a Hyundai Kona? Then take a look at this second hand one from this dealer in High Wycombe, that’s got a cc petrol motor, manual transmission and 25,492 miles on the dash.

1/20

1/20

160Kw N Line S 65Kwh

6,000miAutoElectric

£39,990

Doncaster

~£1,004/pm

Now available to test drive at your request is this suv Kona 160Kw N Line S 65Kwh with 6,000 miles clocked up on the dash, automatic transmission and a ltr electric motor.

1/32

1/32

Premium

23,514miAutoElectric

£18,825

Online Dealer

~£473/pm

Up for sale and ready for you to drive away is this Hyundai Kona Premium, it is equipped with a cc electric motor with automatic transmission. This low mileage one currently available from this dealer in Online Sale comes finished in red and has only got 23,514 mi clocked up on the dashboard.

1/19

1/19

64Kwh Premium Se 7Kw Charger

24,000miAutoElectric

£16,995

Cambridge

~£427/pm

Up for sale and ready for its next owner to drive home is this Hyundai Kona 64Kwh Premium Se 7Kw Charger in . This second hand model has 24,000 miles clocked up on the dashboard and contains a LTR electric engine.

1/46

1/46

Premium

20,341miAutoElectric

£16,060

Online Dealer

~£403/pm

On offer at the brilliant price of just £16,215 is this Hyundai Kona that has automatic transmission and a l electric engine. This second-hand model has been finished in blue and has 20,341 miles on the dash.

1/1

1/1

1.6 Gdi Hybrid Se Connect Dct

6,000miAutoHybrid1.6L

£20,700

Stoke-on-Trent

~£520/pm

Interested in buying a Kona 1.6 Gdi Hybrid Se Connect Dct? Then have a more in depth look at this second-hand, but like new one that is in a superb, like new condition . This particular model that is now available for viewing at our showroom located in the Stoke-on-Trent area has clocked up 6,000 miles and comes fitted out with a 1.6 ltr hybrid engine.

1/60

1/60

Electric

20,434miElectric

£17,495

Milton Keynes

~£439/pm

First registered in : Second-hand Hyundai Kona Electric with a ltr electric motor, transmission and only 20,434 mi on the dash.

1/16

1/16

1.0 Tgdi 48V Mhev Se Connect

5,707miManualPetrol1.0L

£15,998

Workington

~£402/pm

This Hyundai Kona 1.0 Tgdi 48V Mhev Se Connect is fitted out with manual transmission and a 1.0 L petrol engine with 5,707 miles clocked-up on the dash. This second-hand model from this dealer comes in the tone of white.

1/18

1/18

1.0 T-gdi Play Edition

43,319miManualPetrol1.0L

£10,999

London

~£276/pm

Featuring a 1.0L petrol motor with manual transmission, this second hand Hyundai is available for sale with a red finish and has 43,319mi on the dash.

Acquiring a used Hyundai Kona with finance can be a wise and manageable decision when you're acquainted with the right knowledge. Here's a simplified guide to various finance options and steps you might consider:

Embarking on the financial journey to acquire a used Hyundai Kona requires thorough financial comprehension and a meticulous review of your chosen finance option. Whether through self-education or professional advice, ensure that your decision-making is informed and robust. With careful planning and knowledge, you can bask in the joy of driving your Kona, comforted by the solidity of your financial planning.

The Hyundai Kona, a compact and stylish SUV, has been turning heads on British roads, celebrated for its blend of modern design, efficiency, and versatility. In a country where urban living and outdoor adventures are equally cherished, the Kona has established itself as a versatile and trendy choice. In this article, we'll explore the standout features of the Hyundai Kona, introduce its competitors in the UK market, and discuss the appealing financing options available for this fashionable SUV.

Hyundai Kona Key Features:

Rivals in the UK Market:

The Hyundai Kona faces competition from other compact SUVs in the UK's SUV segment:

Conclusion:

The Hyundai Kona, with its contemporary design, efficient powertrains, and practical versatility, has become a stylish and versatile SUV for British drivers who value both urban living and outdoor exploration. In a country where style and practicality matter, the Kona delivers a compelling package. With flexible financing options, owning this fashionable SUV becomes an accessible and attractive proposition for those who seek a vehicle that complements their UK lifestyle.

Hyundai Kona data for the amount in stock, average price, age and mileage throughout the UK and by county.

| County | Stock | Avg Price | Avg Age | Avg Mileage | Recent Sales |

|---|---|---|---|---|---|

| All | 1,601 | £18,671 | 3 | 22,530 | 4,385 |

| Aberdeen City | 22 | £19,314 | 3 | 14,287 | 47 |

| Angus | 2 | £17,490 | 3 | 4,592 | 5 |

| Antrim | 4 | £16,995 | 3 | 33,178 | 7 |

| Ards | 1 | £14,999 | 3 | 45,538 | 3 |

| Banbridge | 1 | £12,450 | 4 | 45,000 | 3 |

| Bedfordshire | 17 | £21,453 | 3 | 20,380 | 35 |

| Belfast | 4 | £25,249 | 1 | 10,980 | 44 |

| Berkshire | 26 | £24,273 | 2 | 12,074 | 47 |

| Blaenau Gwent | 3 | £12,899 | 5 | 41,457 | 7 |

| Brent - Greater London | 1 | £12,490 | 5 | 24,326 | - |

| Bristol | 21 | £22,085 | 3 | 17,853 | 60 |

| Bromley - Greater London | 1 | £15,995 | 4 | 33,000 | 2 |

| Buckinghamshire | 24 | £20,185 | 2 | 18,472 | 61 |

| Cambridgeshire | 44 | £17,990 | 3 | 19,180 | 58 |

| Cardiff | 16 | £19,226 | 3 | 14,319 | 22 |

| Carmarthenshire | 1 | £10,995 | 5 | 47,000 | 1 |

| Ceredigion | 2 | £16,493 | 4 | 25,259 | 22 |

| Cheshire | 53 | £19,399 | 3 | 23,564 | 148 |

| City of Edinburgh | 21 | £21,885 | 3 | 17,433 | 94 |

| City of London - Greater London | 58 | £21,028 | 2 | 17,514 | 139 |

| Clackmannanshire | 1 | £17,498 | 4 | 16,387 | 1 |

| Conwy | 11 | £26,521 | 2 | 12,567 | 3 |

| Cornwall | 1 | £17,250 | 6 | 25,940 | 25 |

| County Durham | 8 | £19,360 | 3 | 17,080 | 66 |

| Craigavon | 1 | £12,995 | 4 | 22,830 | 4 |

| Croydon - Greater London | 3 | £16,561 | 3 | 30,375 | 14 |

| Cumbria | 13 | £17,557 | 3 | 15,094 | 37 |

| Denbighshire | 1 | £13,695 | 3 | 19,000 | - |

| Derbyshire | 24 | £18,256 | 3 | 21,654 | 67 |

| Derry | 2 | £21,815 | 3 | 14,094 | 1 |

| Devon | 26 | £21,169 | 2 | 18,238 | 80 |

| Dorset | 8 | £23,791 | 2 | 10,238 | 26 |

| Down | 2 | £15,845 | 3 | 31,129 | 6 |

| Dumfries and Galloway | 1 | £27,995 | 2 | 9,387 | 8 |

| Dundee City | 6 | £20,415 | 3 | 19,923 | 20 |

| Dungannon | 5 | £21,588 | 2 | 16,853 | 5 |

| Ealing - Greater London | 1 | £18,000 | 3 | 27,000 | - |

| East Ayrshire | 2 | £11,999 | 6 | 39,567 | 6 |

| East Dunbartonshire | 1 | £11,498 | 6 | 51,058 | 2 |

| East Riding of Yorkshire | 18 | £19,020 | 3 | 21,665 | 47 |

| East Sussex | 8 | £25,519 | 2 | 8,701 | 30 |

| Essex | 48 | £21,373 | 2 | 18,990 | 85 |

| Falkirk | 12 | £21,796 | 3 | 16,166 | 32 |

| Fermanagh | 1 | £12,995 | 3 | 42,000 | 2 |

| Fife | 6 | £15,747 | 4 | 29,501 | 24 |

| Flintshire | 1 | £12,294 | 3 | 39,528 | - |

| Glasgow City | 22 | £21,684 | 3 | 19,304 | 65 |

| Gloucestershire | 12 | £19,437 | 3 | 16,080 | 81 |

| Greater Manchester | 70 | £18,962 | 3 | 20,569 | 194 |

| Hampshire | 31 | £18,357 | 3 | 23,992 | 116 |

| Harrow - Greater London | 2 | £14,495 | 2 | 8,551 | 1 |

| Havering - Greater London | 9 | £19,538 | 2 | 14,437 | 27 |

| Herefordshire | 10 | £18,590 | 3 | 19,312 | 28 |

| Hertfordshire | 21 | £18,899 | 3 | 20,736 | 60 |

| Highland | 5 | £17,757 | 3 | 23,984 | 29 |

| Hounslow - Greater London | 5 | £17,140 | 3 | 23,787 | 12 |

| Isle of Wight | 6 | £17,998 | 4 | 22,574 | 10 |

| Kent | 54 | £19,943 | 2 | 17,368 | 162 |

| Lancashire | 51 | £18,118 | 3 | 24,861 | 121 |

| Leicestershire | 44 | £18,007 | 3 | 28,171 | 92 |

| Lewisham - Greater London | 3 | £25,162 | 4 | 10,039 | 12 |

| Lincolnshire | 43 | £18,687 | 3 | 21,290 | 119 |

| Lisburn | 3 | £13,147 | 5 | 30,841 | 3 |

| Magherafelt | 1 | £15,450 | 4 | 24,000 | - |

| Merseyside | 15 | £20,173 | 2 | 13,513 | 38 |

| Moray | 2 | £19,847 | 5 | 19,492 | 8 |

| Newport | 3 | £21,830 | 2 | 18,689 | 22 |

| Newry and Mourne | 12 | £17,415 | 3 | 27,072 | 21 |

| Newtownabbey | 2 | £15,745 | 4 | 27,495 | 5 |

| Norfolk | 18 | £21,575 | 3 | 22,285 | 42 |

| North Ayrshire | 2 | £12,376 | 5 | 33,096 | 5 |

| North Down | 1 | £9,690 | 4 | 78,055 | 6 |

| North Lanarkshire | 5 | £14,169 | 5 | 30,152 | 28 |

| North Yorkshire | 14 | £19,843 | 3 | 24,977 | 62 |

| Northamptonshire | 15 | £19,848 | 3 | 19,893 | 47 |

| Northumberland | 1 | £14,299 | 4 | 47,000 | 13 |

| Nottinghamshire | 43 | £18,660 | 3 | 21,991 | 97 |

| Omagh | 2 | £15,494 | 3 | 28,543 | 1 |

| Oxfordshire | 19 | £20,138 | 2 | 17,310 | 40 |

| Perth and Kinross | 3 | £19,665 | 4 | 25,399 | 10 |

| Powys | 6 | £21,001 | 2 | 10,650 | 14 |

| Redbridge - Greater London | 1 | £18,500 | 2 | 23,260 | - |

| Renfrewshire | 15 | £20,691 | 3 | 20,904 | 61 |

| Rhondda Cynon Taf | 9 | £19,811 | 3 | 14,367 | 23 |

| Richmond upon Thames - Greater London | 13 | £25,408 | 2 | 8,223 | 33 |

| Shropshire | 18 | £18,545 | 4 | 21,303 | 27 |

| Somerset | 14 | £19,207 | 3 | 18,712 | 41 |

| South Ayrshire | 1 | £18,498 | 4 | 13,154 | 8 |

| South Lanarkshire | 4 | £14,998 | 4 | 26,800 | 33 |

| South Yorkshire | 22 | £23,694 | 2 | 13,104 | 109 |

| Staffordshire | 49 | £19,435 | 3 | 21,411 | 121 |

| Stirling | 5 | £20,558 | 3 | 15,214 | 31 |

| Strabane | 3 | £14,197 | 4 | 40,139 | 2 |

| Suffolk | 34 | £20,806 | 2 | 13,859 | 57 |

| Surrey | 28 | £23,967 | 2 | 14,149 | 45 |

| Swansea | 7 | £25,131 | 2 | 9,848 | 26 |

| Tyne and Wear | 21 | £18,289 | 3 | 17,458 | 75 |

| Waltham Forest - Greater London | 1 | £17,599 | 2 | 24,510 | 1 |

| Warwickshire | 15 | £26,493 | 2 | 8,794 | 30 |

| West Dunbartonshire | 3 | £17,331 | 4 | 25,401 | 6 |

| West Lothian | 3 | £15,665 | 3 | 30,806 | 17 |

| West Midlands | 88 | £17,983 | 3 | 22,529 | 207 |

| West Sussex | 31 | £22,224 | 2 | 12,311 | 63 |

| West Yorkshire | 58 | £20,929 | 3 | 17,073 | 196 |

| Wiltshire | 27 | £21,845 | 3 | 16,714 | 86 |

| Worcestershire | 43 | £18,694 | 3 | 22,207 | 100 |