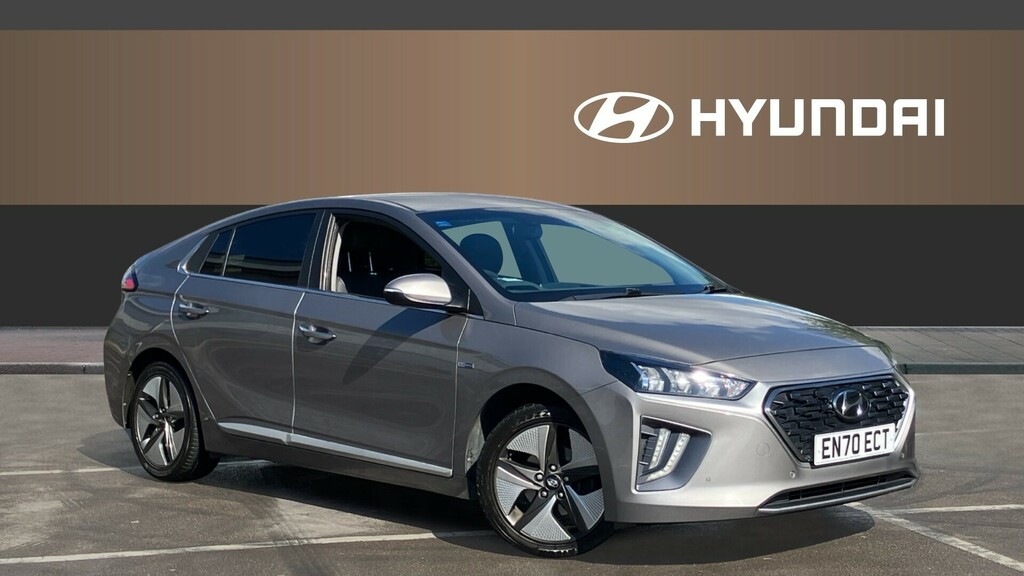

2019 Hyundai Ioniq

1.6 H-gdi Premium Dct Euro 6 Ss

64,284miAutoHybrid1.6L

£11,950

Lisburn

~£300/pm

Now on the market and ready for you to drive home is this Hyundai with a 1.6 litre hybrid engine and 64,284 miles on the dashboard.

Representative example: borrowing £6,500 over 5 years with a representative APR of 19.9%, an annual interest rate of 19.9% (Fixed) and a deposit of £0.00, the amount payable would be £166.07 per month, with a total cost of credit of £3,464.37 and a total amount payable of £9,964.37.

1,469 cars

1/23

1/23

1.6 H-gdi Premium Dct Euro 6 Ss

64,284miAutoHybrid1.6L

£11,950

Lisburn

~£300/pm

Now on the market and ready for you to drive home is this Hyundai with a 1.6 litre hybrid engine and 64,284 miles on the dashboard.

1/43

1/43

1.6 Gdi Hybrid Premium Se Dct

70,944miAutoHybrid1.6L

£13,998

Sheffield

~£352/pm

Fitted with a 1600 CC hybrid motor with automatic transmission; this second hand hatchback is on the market and ready for you to drive home with 70,944 miles on the dash.

1/34

1/34

Se

49,799miAutoHybrid1.6L

£13,300

Online Dealer

~£334/pm

Up for sale and ready for its new owner to drive away is this hatchback vehicle for the total price of only £13,300. This dealership also gives its customers the option to purchase with manageable monthly repayments to suit all budgets with instalment plans beginning at only £ monthly.

1/16

1/16

1.6 Gdi Plug-in Hybrid Premium Se Dct

56,720miAutoHybrid1.6L

£16,498

Grangemouth

~£414/pm

A 1600 CC hybrid engine and automatic transmission are only some of the attributes that this Hyundai has to offer its driver.

1/20

1/20

Ioniq Premium Se Fhev

45,907miAutoHybrid1.6L

£15,495

Croydon

~£389/pm

This second hand Hyundai finished in the shade of grey is currently available for sale with the added option to buy it on credit.

1/22

1/22

1.6 Gdi Hybrid Premium Se Dct

17,044miAutoHybrid1.6L

£19,630

Gateshead

~£493/pm

Drive this second-hand Hyundai Ioniq 1.6 Gdi Hybrid Premium Se Dct for £19,630. Finance plans commence from around £ every month for this vehicle featuring a 1600 CC hybrid motor with automatic transmission.

1/19

1/19

1.6 H-gdi Premium Se Dct Euro 6 Ss

31,211miAutoHybrid1.6L

£15,990

Edinburgh

~£402/pm

At £15,990 you can buy this second hand Hyundai Ioniq from this dealership in Edinburgh which is fitted out with a 1.6 LTR hybrid motor and automatic transmission.

1/25

1/25

168Kw Premium 77 Kwh Part Leather Hatch

3,644miAutoElectric1.0L

£32,990

Hessle

~£828/pm

At this car dealership there's a low price for this second hand Ioniq 168Kw Premium 77 Kwh Part Leather Hatch that has automatic transmission with a 1.0l electric engine and 3,644 miles clocked up on the dashboard.

1/17

1/17

1.6 Gdi Plug-in Hybrid Premium Se Dct

39,949miAutoHybrid1.6L

£17,698

Livingston

~£444/pm

Fitted with a 1.6l hybrid motor and automatic transmission, this second hand Hyundai from this dealership in Livingston is available to buy in white and has 39,949 miles on the clock.

1/23

1/23

Premium

16,952miAutoHybrid1.6L

£15,600

Online Dealer

~£392/pm

Available at this dealer in Online Sale: Hyundai Ioniq - 16,952 miles, automatic transmission and a 1.6 litre hybrid engine.

1/29

1/29

1.6 Gdi Hybrid Premium Se Dct

51,557miAutoHybrid1.6L

£15,140

Cardiff

~£380/pm

On offer at the bargain price of just £15,140 is this Hyundai Ioniq that contains a 1.6 Ltr hybrid engine with automatic transmission. This second-hand one has 51,557 miles clocked up on the dashboard and has been finished in the shade of blue.

1/23

1/23

Ioniq First Edition Fhev

45,685miAutoHybrid1.6L

£13,700

Online Dealer

~£344/pm

At the remarkable price of only £13,700 is this Hyundai Ioniq that features automatic transmission and a 1.6l hybrid motor. This used one has 45,685 miles on the dashboard and has been finished in the shade of grey.

1/18

1/18

1.6 Gdi Hybrid Premium Dct

42,347miAutoHybrid1.6L

£14,998

Winsford

~£377/pm

Fitted out with a 1600cc hybrid motor and automatic transmission - this red used Ioniq 1.6 Gdi Hybrid Premium Dct is on the market and ready for you to drive home with 42,347 miles on the clock.

1/11

1/11

1.6 Gdi Premium Se Hybrid Dct

73,990miAuto1.6L

£12,699

London

~£319/pm

Available from this dealership in London: Hyundai Ioniq 1.6 Gdi Premium Se Hybrid Dct - 1.6l engine, automatic transmission and 73,990 miles.

1/31

1/31

73Kwh Ultimate Hatchback 217 Ps

11,893miAutoElectric

£31,350

Richmond

~£787/pm

Now available to test-drive at our showroom is this Hyundai Ioniq with only 11,893 miles on the dashboard.

1/28

1/28

Premium

33,605miAutoElectric

£11,600

Online Dealer

~£291/pm

This low mileage Ioniq comes fitted with automatic transmission and a Ltr electric motor. It is on the market and ready for you to drive away in a silver finish with only 33,605 miles on the dash.

1/6

1/6

1.6 Gdi Hybrid Premium Dct

44,317miAutoHybrid1.6L

£17,398

Goole

~£437/pm

Become the next owner of this Hyundai Ioniq 1.6 Gdi Hybrid Premium Dct that has a 1.6 litre hybrid motor with automatic transmission. This second hand model currently available from this dealership in Goole comes in grey and has got 44,317 miles on the clock.

1/1

1/1

1.6 Gdi Hybrid Premium Se Dct

12,109miAutoHybrid1.6L

£18,899

Winsford

~£475/pm

Painted in black, this Hyundai has got 12,109 miles clocked up on the dash and is fitted out with a 1600 CC hybrid motor and automatic transmission. First Registered in 2021, it is currently up for sale and ready for its next owner to drive away for only £18,299.

1/1

1/1

88Kw Premium 28Kwh

36,746miAutoElectric1.0L

£11,017

Shrewsbury

~£277/pm

Check out the fabulous price at this dealer on this second hand, low mileage Hyundai Ioniq 88Kw Premium 28Kwh that has a 1.0 litre electric engine, automatic transmission and only 36,746 miles clocked-up on the dash.

1/1

1/1

Electric

36,338miElectric

£12,250

Doncaster

~£308/pm

On display at this car dealership's showroom in Doncaster is this Hyundai Ioniq in blue fitted with a transmission and CC electric engine.

1/41

1/41

Premium Se

39,873miAutoHybrid1.6L

£16,257

Bristol

~£408/pm

This hatchback used car has a mere 39,873 miles on the clock and it's been used for under a year.

1/23

1/23

Se

40,369miAutoHybrid1.6L

£13,900

Online Dealer

~£349/pm

On offer is this Hyundai Ioniq coming in grey; this model has got 40,369 miles clocked up on the dash and incorporates a 1.6L hybrid engine with automatic transmission.

1/38

1/38

Premium

38,908miAutoHybrid1.6L

£14,203

Louth

~£357/pm

There is an awesome price at this dealer in Louth on this second hand, low mileage Hyundai that has automatic transmission, a 1600 cc hybrid engine and a mere 38,908 miles clocked-up on the dash.

1/23

1/23

135 Bhp

15,525miAutoElectric1.0L

£15,495

Liverpool

~£389/pm

On offer at our great price of just £15,495 is this Hyundai Ioniq 135 Bhp, it features a 1.0l electric motor with automatic transmission and has 15,525 miles clocked-up on the dashboard.

Research the Vehicle:

Finance Options:

Quotes and Comparisons:

Credit Score:

Budgeting:

Understand the Terms:

Negotiate:

Seal the Deal:

Insurance:

End-of-Agreement Decisions:

When considering car finance, it's essential to choose an option that aligns with your financial circumstances and future predictions. Always consult with financial advisors or professionals if in doubt.

The Hyundai Ioniq is an innovative eco-friendly vehicle that offers a unique combination of efficiency, style, and advanced technology. Available in hybrid, plug-in hybrid, and fully electric powertrains, the Ioniq stands out as an attractive choice in the competitive green vehicle market. In this piece, we'll explore the key features of the Hyundai Ioniq and discuss the advantages of financing this appealing model for the UK audience.

Hyundai Ioniq: Features and Specifications

The Hyundai Ioniq offers a variety of features that make it an enticing option for drivers seeking an eco-friendly and stylish vehicle:

Efficient Powertrains: The Ioniq is available with a choice of hybrid, plug-in hybrid, and fully electric powertrains, ensuring excellent fuel efficiency and low emissions.

Aerodynamic Design: The Ioniq boasts a sleek and aerodynamic design, with its fluid lines, modern styling, and distinctive Hyundai grille.

Spacious Interior: The Ioniq offers a comfortable and roomy cabin, with ample passenger space, flexible seating configurations, and a range of practical storage solutions.

Advanced Technology: The Ioniq is equipped with a host of modern technology, including a touchscreen infotainment system, smartphone integration, and various driver assistance features.

Financing a Hyundai Ioniq

Opting to finance a Hyundai Ioniq can make this eco-friendly vehicle more accessible, with several key benefits:

Manageable Payments: Financing an Ioniq allows you to spread the cost over a set period, typically between 24 and 60 months, making the purchase price more manageable with smaller monthly payments.

Regular Upgrades: Financing a Hyundai Ioniq enables you to upgrade your vehicle more frequently, ensuring you always drive a model equipped with the latest features and technologies.

Exclusive Offers: Hyundai dealerships and finance partners often present special offers and incentives, such as low-interest rates or deposit contributions, to make financing a new or used Ioniq even more enticing.

Conclusion

The Hyundai Ioniq is an exceptional choice for drivers seeking an eco-friendly and stylish vehicle that offers a unique blend of efficiency, design, and advanced technology. By financing an Ioniq, you can enjoy the benefits of this popular model while taking advantage of manageable payments and flexible finance options. As a symbol of modern eco-friendly automotive design and performance, the Hyundai Ioniq is undoubtedly worth considering.

Hyundai Ioniq data for the amount in stock, average price, age and mileage throughout the UK and by county.

| County | Stock | Avg Price | Avg Age | Avg Mileage | Recent Sales |

|---|---|---|---|---|---|

| All | 1,416 | £17,011 | 4 | 30,913 | 2,428 |

| Aberdeen City | 3 | £16,665 | 5 | 23,637 | 6 |

| Angus | 2 | £13,743 | 6 | 26,463 | 2 |

| Antrim | 1 | £13,995 | 5 | 33,877 | 3 |

| Ards | 1 | £13,490 | 5 | 35,980 | 1 |

| Banbridge | 1 | £12,500 | 4 | 60,000 | 4 |

| Barking & Dagenham - Greater London | 2 | £15,245 | 5 | 84,745 | 2 |

| Barnet - Greater London | 1 | £15,990 | 4 | 38,800 | 4 |

| Bedfordshire | 16 | £15,119 | 5 | 46,777 | 43 |

| Belfast | 10 | £14,902 | 4 | 19,419 | 23 |

| Berkshire | 7 | £15,271 | 4 | 27,637 | 18 |

| Blaenau Gwent | 5 | £15,319 | 3 | 16,264 | 1 |

| Brent - Greater London | 3 | £16,242 | 4 | 53,000 | 3 |

| Bristol | 12 | £14,892 | 3 | 26,593 | 31 |

| Bromley - Greater London | 2 | £15,247 | 4 | 27,500 | 1 |

| Buckinghamshire | 18 | £16,341 | 4 | 23,356 | 31 |

| Cambridgeshire | 57 | £13,875 | 4 | 44,210 | 56 |

| Cardiff | 9 | £14,406 | 4 | 35,412 | 23 |

| Ceredigion | 7 | £16,416 | 4 | 26,253 | 5 |

| Cheshire | 29 | £16,429 | 3 | 25,737 | 70 |

| City of Edinburgh | 26 | £16,601 | 4 | 27,429 | 53 |

| City of London - Greater London | 102 | £14,094 | 4 | 36,861 | 158 |

| Coleraine | 1 | £14,190 | 3 | 40,600 | - |

| Conwy | 2 | £20,495 | 4 | 17,768 | - |

| County Durham | 7 | £15,567 | 4 | 31,348 | 10 |

| Craigavon | 4 | £12,810 | 5 | 31,665 | 1 |

| Croydon - Greater London | 10 | £24,396 | 3 | 33,252 | 19 |

| Cumbria | 2 | £23,995 | 4 | 16,450 | 4 |

| Derbyshire | 27 | £15,098 | 4 | 30,330 | 53 |

| Derry | 1 | £13,450 | 5 | 60,000 | 3 |

| Devon | 17 | £14,223 | 4 | 44,673 | 32 |

| Dorset | 3 | £14,495 | 4 | 33,235 | 12 |

| Down | 2 | £14,995 | 3 | 28,495 | 3 |

| Dumfries and Galloway | 1 | £14,998 | 5 | 42,757 | 1 |

| Dundee City | 2 | £16,247 | 4 | 29,982 | 4 |

| Dungannon | 4 | £26,643 | 2 | 21,073 | 11 |

| Ealing - Greater London | 1 | £12,189 | 5 | 40,686 | 3 |

| East Ayrshire | 4 | £15,709 | 4 | 25,270 | 4 |

| East Dunbartonshire | 1 | £16,698 | 4 | 23,236 | - |

| East Riding of Yorkshire | 22 | £17,701 | 3 | 32,097 | 33 |

| East Sussex | 10 | £21,192 | 4 | 30,592 | 12 |

| Essex | 13 | £14,173 | 4 | 32,118 | 39 |

| Falkirk | 8 | £14,845 | 3 | 39,317 | 9 |

| Fife | 3 | £16,762 | 4 | 30,558 | 11 |

| Glasgow City | 10 | £16,528 | 4 | 22,644 | 20 |

| Gloucestershire | 5 | £14,506 | 3 | 37,690 | 30 |

| Greater Manchester | 105 | £15,778 | 4 | 38,309 | 237 |

| Hampshire | 26 | £24,635 | 3 | 29,374 | 70 |

| Harrow - Greater London | 3 | £16,312 | 3 | 26,554 | 2 |

| Havering - Greater London | 8 | £15,833 | 5 | 31,470 | 14 |

| Herefordshire | 12 | £15,586 | 3 | 24,971 | 11 |

| Hertfordshire | 39 | £14,767 | 4 | 32,483 | 52 |

| Highland | 1 | £17,698 | 5 | 6,034 | 1 |

| Hillingdon - Greater London | 5 | £11,494 | 6 | 57,799 | 9 |

| Hounslow - Greater London | 9 | £13,977 | 3 | 18,250 | 5 |

| Inverclyde | 3 | £17,265 | 4 | 21,611 | 8 |

| Isle of Wight | 1 | £14,799 | 5 | 11,707 | 1 |

| Kensington & Chelsea - Greater London | 1 | £12,450 | 6 | 55,780 | - |

| Kent | 56 | £14,118 | 4 | 37,627 | 71 |

| Lancashire | 45 | £17,809 | 3 | 23,897 | 67 |

| Leicestershire | 14 | £14,203 | 4 | 30,531 | 52 |

| Lewisham - Greater London | 1 | £33,495 | 1 | 4,111 | 4 |

| Limavady | 1 | £13,495 | 4 | 52,000 | 2 |

| Lincolnshire | 31 | £15,699 | 4 | 32,108 | 58 |

| Lisburn | 3 | £14,147 | 4 | 34,122 | 1 |

| Merseyside | 19 | £15,517 | 4 | 31,569 | 45 |

| Merthyr Tydfil | 1 | £14,570 | 3 | 34,341 | - |

| Moray | 2 | £17,995 | 4 | 9,275 | 3 |

| Newport | 11 | £16,241 | 3 | 19,099 | 10 |

| Newry and Mourne | 4 | £29,617 | 4 | 19,907 | 4 |

| Newtownabbey | 1 | £15,800 | 4 | 19,590 | 2 |

| Norfolk | 8 | £15,819 | 4 | 31,161 | 14 |

| North Ayrshire | 2 | £14,420 | 6 | 37,209 | - |

| North Lanarkshire | 8 | £14,662 | 4 | 25,148 | 10 |

| North Yorkshire | 31 | £17,864 | 3 | 32,045 | 47 |

| Northamptonshire | 6 | £14,742 | 3 | 40,926 | 11 |

| Northumberland | 2 | £16,690 | 3 | 22,875 | 2 |

| Nottinghamshire | 31 | £15,152 | 4 | 30,489 | 37 |

| Oxfordshire | 7 | £17,691 | 3 | 17,165 | 11 |

| Pembrokeshire | 1 | £12,995 | 7 | 53,130 | - |

| Perth and Kinross | 2 | £17,427 | 0 | 18,965 | 3 |

| Powys | 2 | £36,495 | 1 | 4,000 | 1 |

| Redbridge - Greater London | 4 | £13,998 | 6 | 47,725 | 3 |

| Renfrewshire | 9 | £15,609 | 4 | 31,811 | 18 |

| Rhondda Cynon Taf | 3 | £23,192 | 3 | 25,657 | 4 |

| Richmond upon Thames - Greater London | 10 | £29,310 | 3 | 13,310 | 8 |

| Shropshire | 11 | £15,706 | 4 | 32,396 | 13 |

| Somerset | 8 | £26,251 | 2 | 20,134 | 16 |

| South Ayrshire | 3 | £15,313 | 4 | 34,925 | 2 |

| South Lanarkshire | 2 | £17,148 | 5 | 17,398 | 12 |

| South Yorkshire | 26 | £15,545 | 4 | 43,316 | 47 |

| Staffordshire | 48 | £15,365 | 3 | 34,401 | 93 |

| Stirling | 6 | £18,415 | 3 | 15,185 | 8 |

| Suffolk | 13 | £14,212 | 5 | 34,563 | 20 |

| Surrey | 9 | £22,171 | 3 | 27,413 | 27 |

| Swansea | 12 | £20,306 | 3 | 26,565 | 11 |

| Tyne and Wear | 24 | £16,238 | 3 | 31,764 | 45 |

| Waltham Forest - Greater London | 1 | £17,995 | 5 | 33,179 | 1 |

| Warwickshire | 12 | £22,225 | 3 | 22,223 | 27 |

| West Lothian | 4 | £14,224 | 5 | 51,522 | 7 |

| West Midlands | 102 | £18,604 | 4 | 26,537 | 143 |

| West Sussex | 15 | £18,382 | 3 | 25,508 | 20 |

| West Yorkshire | 78 | £19,146 | 4 | 30,029 | 118 |

| Wiltshire | 24 | £28,887 | 3 | 16,824 | 35 |

| Worcestershire | 16 | £15,005 | 4 | 41,149 | 33 |